-

Axos BankCosts per monthCosts refer to the first month and may vary in the following month0,00 €Minimum ageChildren's credit cards are often only available with the consent of a legal guardian over 18 years of age.13 YearsCard typeDebitCard systemVisa

- High security standard

- No overdraft fees

- No monthly maintenance fees

Alternative

-

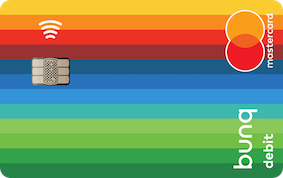

bunqCosts per monthCosts refer to the first month and may vary in the following month0,33 €Minimum ageChildren's credit cards are often only available with the consent of a legal guardian over 18 years of age.0 YearsCard typePrepaidCard systemMastercard

- 24/7 customer support

- Bank account with German IBAN

- No interest or annual fees

First checking - The digital youth account from Axos bank

First Checking is a digital youth account offered by Axos Bank, aimed at providing teenagers with an easy and modern entry into the world of banking and financial management. Axos Bank is an online-only bank headquartered in San Diego, USA. It offers a wide range of services for both personal and business customers. Clients can access the online platform and app anytime with a device, an internet connection, and their login, allowing them to monitor and manage their finances.

Learning financial management with the teen checking account

The First Checking account from Axos Bank is specifically designed for young people aged 13 to 17 and offers a range of features and benefits to support them on their path to financial independence and to learn how to manage money. The account comes with its own debit card.

The debit card for teenagers

With the First Checking account debit card, teenagers can make purchases in physical stores and supermarkets. The card is accepted at most places where credit cards are accepted and can also be used for contactless payments. Additionally, it can be used for online shopping, online transfers, or cash withdrawals from ATMs. This allows teenagers to quickly and easily access cash when needed, promoting responsible financial behavior and financial education.

In control: The banking app

Parents or guardians can monitor the debit card and set limits through the associated banking app. This allows parents to support and oversee their children's financial responsibility. Teenagers can also use the app and the online banking system to check their account balances, ensuring they are always aware of their financial situation.

Potential costs of the first checking account

First Checking does not charge monthly maintenance fees, and the account is generally set up to prevent overdrafts. This means that transactions are usually declined if there are insufficient funds in the account, rather than allowing overdrawn accounts and charging high fees. However, fees may apply if the First Checking account debit card is used at ATMs that are not part of the Axos Bank network. These fees depend on the ATM operators. Currency conversion fees may apply when using the debit card abroad.

Security first

Axos Bank has implemented robust security measures to ensure the integrity of the accounts and the financial security of the account holders. Here are some security aspects considered for First Checking accounts:

- Password and PIN: Secure passwords and/or PIN codes are created when opening a First Checking account to ensure that only authorized persons can access the account.

- Multi-Factor Authentication: Axos Bank offers the option to increase account security by enabling two-factor authentication. In addition to the password or PIN, another security code is required, which is sent, for example, via SMS to the account holder's mobile phone.

- Account Protection: Axos Bank has strict security protocols to prevent unauthorized access to account information and functions.

- Transaction Monitoring: The bank monitors transactions and can identify suspicious activities. Notifications are sent to account holders in case of suspicious transactions.

- Parental Control: Parents or guardians who have control over their child's account can ensure that money is used responsibly by setting limits and monitoring transactions.

- Encryption: Axos Bank uses encryption technologies to ensure that all online transactions and communications are secure and private.

- Loss or Theft of the Debit Card: In case of a lost or stolen debit card, the bank immediately reports the loss and blocks the card to prevent unauthorized transactions.

Online customer service

Axos Bank offers comprehensive customer service to meet the needs of its customers and effectively address questions or concerns. Customer service channels include a telephone hotline, email service, and live chat. Additionally, Axos Bank provides information on the online portal and in the app within the FAQs.