✓ Hotel accommodation for hospital visits

Finances

Credit check

Employee benefits

Integration with accounting

Services

Insurance

Concierge Services

Online Banking

App

Travel benefits

Foreign Usage

Foreign currency costs: 0

Travel insurance

Car insurance

✓ Refunds for delayed or lost baggage

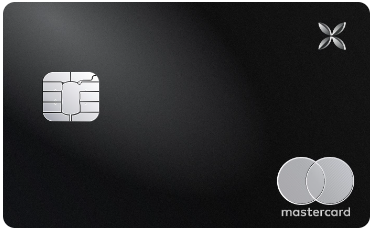

Qonto X Card – costs and conditions of the premium business credit card reviewed!

Business trips can be extremely nerve-wracking. To ease travel stress and subsequent accounting, Qonto Bank offers a special debit card that aims to combine functionality with exclusivity. This premium metal business credit card not only stands out with its stylish design but also offers a range of benefits tailored specifically to the needs of demanding business people and companies. Below, find out the main features of this card and the associated costs.

All advantages of the Qonto X Card at a glance

The Qonto X Card is an exclusive metal Mastercard debit card with these benefits for business customers:

- Payment limits: You can pay up to €200,000 per month.

- Real exchange rate: Receive the actual exchange rate for foreign currency payments.

- Outstanding design: The metal card weighs 17 g and boasts an attractive design.

- Premium insurance: Enjoy worry-free travel thanks to comprehensive insurance benefits.

- Concierge service: Take advantage of the exclusive concierge service for reservations and information.

- Airport lounges: Benefit from access to over 1,100 airport lounges worldwide.

- Free legal advice: Five free online legal consultations for contracts or disputes per year.

Transaction costs and prices of the X Card

The Qonto X Card is a Mastercard available for €20 per month. It offers high payment and withdrawal limits of up to €200,000 and €15,000 per month, respectively, along with unlimited free cash withdrawals. Foreign currency payments are also free of charge.

Insurance with the Qonto X Card

Travel insurance with Qonto is also comprehensively covered by the X Card:

- Travel luggage and personal belongings: Coverage up to €1,000 per incident.

- Assistance and repatriation: Actual costs are covered.

- Hotel stay during hospital visits: Up to €3,250 per incident.

- Flight and train delays: Compensation up to €800 per incident.

- Medical expenses abroad: Up to €155,000 per incident.

- Trip cancellation insurance: Up to €5,000 per year.

- Delayed luggage: Up to €800 per incident.

- Car rental insurance: Up to €5,000 per year.

Lounge access with the Qonto X Card

The Mastercard also offers access to airport lounges to make your business trips as pleasant as possible. The first lounge use at one of the over 1,100 airport lounges worldwide is initially free, after which each entry costs €30.

The Qonto hotline

The Qonto hotline is available to you seven days a week. You can reach Qonto's customer service via chat, phone, or email. The phone number for German support is +49 800 7241762, and the email address is hallo@qonto.eu. You can report problems and ask questions at any time. For more information, visit the Qonto website.

Conclusion: is the Qonto Card X worth it?

With impressive payment limits, comprehensive insurance coverage, and access to exclusive services such as concierge service and VIP lounges at airports, the Qonto X Card delivers a high standard among business credit cards. If comfortable travel and extensive security are important to you, this card might be the right choice!

Other cards from Qonto

If you are looking for a card with different conditions from this provider, you might also be interested in the Qonto Fuel card or the Qonto Plus Card!