✓ Investing money sustainably

-

Bling SparbäumeDeposit feefreeMinimum age0 YearsMinimum savings rate€1

- Invest from 1 €

- Deposit and withdraw money daily

- The whole family saves together

- Money is invested sustainably

Alternative

-

PostbankDeposit feefreeMinimum age7 YearsMinimum savings rate€25

- Personalized advice near you

- 340 ETFs available as savings plans

- Combination with youth checking account

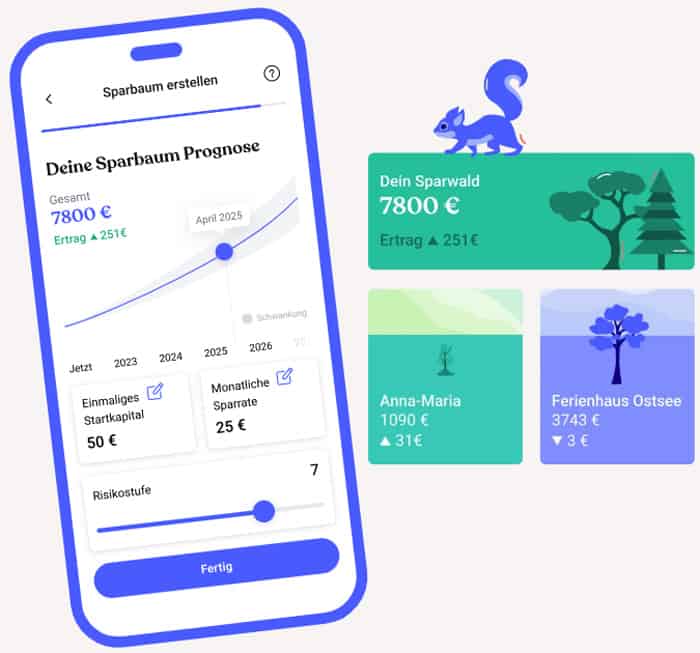

Bling makes investing easy and family-friendly

Easy investing with Junior Depots trough savings trees

Bling found that 84 percent of parents in Germany have not invested in capital markets, likely due to the complexity of many products. Bling’s savings trees are designed for families who are new to the stock market and investments. The company uses playful visualizations and simple explanations from experts to make investing more accessible. All functions are managed via an app, eliminating the need for complicated paperwork.

Affordable investing - Starting from 1 Euro

Families can invest in sustainable options with Bling’s savings trees starting from just one euro per month. Contributions can be made flexibly, determining how much, how often, and when to deposit money.

Investing with Bling is also cost-effective as the young company charges no major fees, only 0.59% per year directly from the fund volume.

Depositing money with Bling’s savings trees

Depositing money is very simple. The balance in the savings trees can be increased and withdrawn daily. The whole family can participate, as deposits are made conveniently via IBAN transfer. The savings plan can be managed flexibly, with customers deciding when and how much to deposit.

Risk-Free investing for children

Families can choose from ten different risk levels to match their individual preferences and investment goals. The money invested in savings trees is globally diversified and invested exclusively in sustainable options (e.g., stocks or bonds).

By distributing funds through the asset manager Evergreen across over 2500 sustainable stocks, the company minimizes the risk of loss.

Sustainable and long-term investing

The sustainable Leipzig-based asset manager Evergreen manages the funds, emphasizing "impact investments" that focus on positive environmental and social outcomes. Investments are made only in environmentally friendly forms.

From pocket money app to successful investment platform

Nils Feigenwinter and Leon Stephan have offered a family banking solution with Bling since summer 2022. With the Bling card and app, children and teenagers can manage their own payments. According to Bling, tens of thousands of families use it daily.

Bling made headlines at the end of last year by securing an additional 3.5 million euros during a challenging funding period. Peak from Amsterdam led the investment round, with participation from the founders of Amorelie, Orderbird, and IDnow. Previously, business angels Verena Pausder and André Schürrle were already involved.

To find the right junior custody account, parents should compare several providers. Discover more junior depots in our tests!