✓ Individual sub-accounts

Finances

Credit check

Employee benefits

Cards included: 1

Integration with accounting

✓ Call money account

Services

Cashback 0.1 %

Insurance

Concierge Services

Online Banking

App

Travel benefits

Foreign Usage

Foreign currency costs: 0

Travel insurance

Car insurance

N26 Business Smart – The corporate credit card in Review

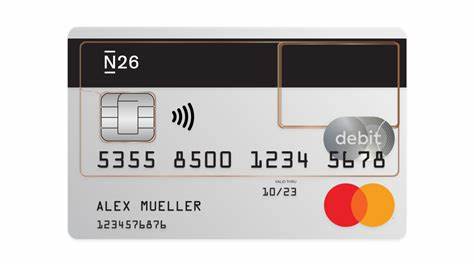

When opening an N26 Smart Business subscription, customers receive a versatile Mastercard debit card with their online checking account, which helps manage their money. In our review, we have gathered the most important information about the card functions and benefits of the N26 Smart subscription for you.

Costs and conditions of the N26 corporate credit card with the smart subscription

N26 Business Smart with the Smart subscription costs €4.90 per month and is exclusively for self-employed individuals and freelancers who operate under their own name. Therefore, only your name, not a company name, can appear on the account and card. For a fee of €4.90 per month, users have access to all essential functions.

Personalized debit card

With the N26 Smart online account, you receive a personalized physical debit card in one of five attractive colors: Rhubarb, Ocean, Sand, Aqua, and Slate. This card allows you to make cashless payments conveniently and securely. Additionally, you can request a free virtual card with its own card number for extra security when shopping online. If you want another physical card, you can order one via the N26 app for a one-time fee of €10.

Payment options and money management

The N26 corporate credit card provides you with various flexible payment options and money management features. Here are the key points summarized for you:

Mobile payments

With all N26 checking accounts, you have the option of contactless payments, either via card or smartphone. As an N26 customer, you automatically receive a digital N26 Mastercard with NFC technology, allowing you to pay conveniently with your smartphone. Supported mobile payment options include:

- Apple Pay: Confirm payments with Apple Pay via fingerprint (Touch ID) or Face ID.

- Google Pay: Use NFC technology for payments and pay via fingerprint or password. Card information remains protected.

- Samsung Pay: All Samsung users can use Samsung Pay, which also utilizes NFC technologies.

- PayPal: Easily add the digital N26 Mastercard to PayPal.

Payments in foreign currencies

Your N26 debit card is an excellent payment method for international travel. Whether shopping online, in stores, or using apps, you can pay in foreign currencies without worrying about additional fees. The card can be used wherever Mastercard is accepted. N26 does not charge fees for payments in foreign currencies. If you have an N26 You or N26 Metal account, you can also withdraw cash worldwide without fees at ATMs. With a Smart subscription, you can make 3 to 5 free cash withdrawals abroad depending on the country. The N26 app also offers a handy ATM finder.

Earn interest (savings account)

With the free N26 savings account available in the app, you can easily and conveniently earn interest. Interest rates vary depending on the different subscriptions. With an N26 Smart account, you currently earn 2.26% p.a. interest on your savings. As a new customer, you can enjoy an interest rate of 2.6% p.a. for the first 12 months. After this promotion, the standard rates apply, which may vary annually and are updated on the website.

The N26 savings account does not have deposit limits. You can access and manage your money anytime. Interest rates are calculated daily and accurately. Your money is protected up to €100,000 by the German deposit insurance system. You can use the N26 app to open your savings account and grow your savings.

Keep track of your money

The N26 app and the N26 Business Smart account offer several practical features to simplify your financial overview. Here are the most important features explained:

Money management with “spaces”

With your N26 checking account, you can create up to 10 sub-accounts called "Spaces." Each of these accounts can be assigned its own IBAN to make money management clearer. You can customize each sub-account with its own name, subject, and savings goals. This greatly simplifies planning individual expenses.

You can also create rules to automate savings. Set up standing orders or direct debits to pay bills directly from the Spaces. This helps better plan spending, as only the money in the Spaces can be used. SEPA transfers to and from the Spaces with their own IBANs are also possible.

Additionally, you can save money with the roundup rule without consciously thinking about it: Each card payment is automatically rounded up, and the saved amounts are stored in a Space of your choice. The income splitter allows you to automatically distribute transfers to your sub-accounts, ensuring you have enough money set aside for upcoming expenses. Your finances are optimally organized.

Insights feature

The Insights feature in the N26 app helps you keep track of your financial situation at all times. It categorizes each payment in real-time and clearly displays recurring payments. It also compares your current spending behavior with a 3-month average to show you how you are spending your money. This makes it easy to check where you might be overspending and adjust your spending accordingly.

Customer service

N26 customer service is available seven days a week to answer questions about the N26 checking account and money management issues. It can be easily contacted through the N26 app and is available in German, English, French, Italian, and Spanish. Additionally, the N26 Support Center (contact details can be found on the N26 website) provides useful information and answers to frequently asked questions about the N26 Smart checking account.

Partner offers

N26 offers its customers a variety of benefits and exclusive offers accessible through the N26 app. These offers span various life areas, from health and personal development to shopping and entertainment. To take advantage of these offers, customers simply need to open the N26 app, go to the "Explore" tab, and check under "Partner Offers." There, they can find a list of current partner offers and follow the instructions to redeem their codes and enjoy the benefits. Previous partners included well-known brands such as Zalando, Booking.com, Headspace, and Adidas.

Other Cards from N26

If you are looking for a card with different conditions from this provider, you might also be interested in the N26 Business You and N26 Business Standard corporate credit cards!