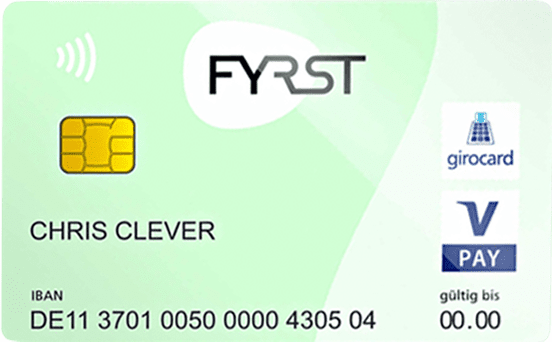

The Fyrst Card Plus Corporate Credit Card

The digital bank Fyrst offers the Fyrst Card Plus credit card for self-employed individuals and founders: a debit card with similar functions to a credit card. Users receive this card when they open a free Fyrst Base business account. In our clear overview, we have compiled the most important information about the corporate credit card, its conditions, fees, functions, and payment options for you.

Fyrst Account Experiences and Awards

When opening a corporate account, the trustworthiness of the bank is particularly important for new customers. Fyrst has some very good references regarding the credibility of the provider. The Base account was awarded the best digital business account 2023 by Handelsblatt. Additionally, Fyrst received the Financial Award for the Top Business Account 2023 from ntv.

How much does the Fyrst Card Plus cost?

The Fyrst Card Plus is only available with the Fyrst Base business account. Both the card and account management are free with this option. The account can be conveniently opened through the Fyrst website. With Fyrst's account switching service, you can easily transfer the balance from your old business account to the new Fyrst account.

How to apply for the corporate credit card at Fyrst?

Opening a corporate account at Fyrst is very straightforward. Here is the step-by-step process: First, log into your online banking. There you will find the button "Apply for FYRST Card Plus." Click on it and log in as usual. You will be immediately redirected to the application process. Once you have submitted the application, Fyrst will review your request based on the information you provided. If the preliminary review is positive, you will receive the necessary application forms. Once your application has been received and you have provided all required documentation, you will be sent a confirmation. You will usually receive the card within 2 weeks after applying. The prerequisites are that you have good creditworthiness and are of legal age. Additionally, the company's headquarters must be in Germany.

Overview of Payment Options and Card Functions

The Fyrst card is not a conventional credit card, but it offers almost the same (payment) functions. The only difference is that the Fyrst Card Plus, as a debit card, does not include a credit function. This means that funds are directly debited from the business account, and you can only spend as much money as is available in the account. Below, we have listed all card functions, payment functions, and fees for you clearly.

Cash Withdrawals and Limits

Fyrst customers can withdraw cash free of charge at 7,000 ATMs of the Cash Group, including Deutsche Bank, Commerzbank, and Hypovereinsbank. Additionally, cash can also be withdrawn at many participating Shell gas stations and retail stores. However, fees apply for withdrawals at foreign ATMs both domestically and abroad: at the bank counter, 3% or at least 5 euros per transaction are charged, and at ATMs, 2.5% or at least 5 euros are charged. The daily limit for cash withdrawals is 1,000 euros, with no weekly limit.

Transfers

The Fyrst accounts naturally also have an online banking function. With this, real-time transfers can be made in just a few seconds, but these transfers incur a fee of 40 cents per transaction in the free Base account. The transfer limit is 100,000 euros. Another advantage is that transfers can also be made outside of usual banking hours - you can send money quickly even at night or on Sundays.

Fees Abroad

When using the card outside the EU, fees apply. The surcharge for paying for goods and other transactions abroad is 1.85% of the amount to be paid. There is also a fee for foreign currency conversion, which is not fixed and depends on different reference exchange rates. When withdrawing cash in non-EU countries, fees of 1% or at least 5.99 euros apply.