✓ Call money account

Finances

Credit check

Employee benefits

Integration with accounting

✓ Individual subaccounts

Services

Cashback 0.1 %

Insurance

Concierge Services

Online Banking

App

Travel benefits

Foreign Usage EU 0 %

Foreign currency costs: 0

Travel insurance

Car insurance

✓ International health insurance

✓ Luggage insurance

✓ Treatment of medical emergencies

The N26 Business You corporate credit card reviewed!

The german neobank N26 has established itself as one of the leading digital banks in recent years. Especially for self-employed businesspeople, the bank offers a range of different business accounts and credit cards.

In this detailed review, we take a closer look at the You Business subscription. Along with the Metal subscription, this is the most expensive and comprehensive business account from N26.

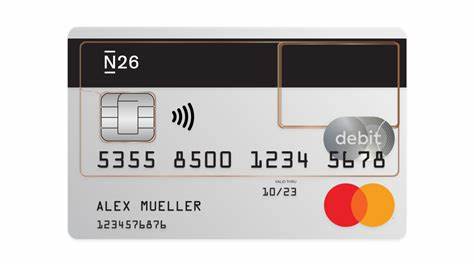

Upon opening a You Business subscription, freelancers receive a free Mastercard debit card with the account, allowing them to manage their money globally. In our detailed review, we have gathered the most important information about the features, benefits, and insurances of the card in the Business You subscription.

What cards are available in you subscription?

After opening an N26 You account, you can choose from one of five visually distinct debit cards: Rhubarb, Ocean, Sand, Aqua, and Slate. Additionally, you can get a physical additional card for a one-time fee of €10 and a free virtual card.

Costs and conditions of the "You" subscription

The N26 Business card in the "You" subscription costs €9.90 per month and is specifically for freelancers and self-employed individuals who operate under their own name. Therefore, only your surname can appear on the account and card, not a company name.

For the monthly fee of €9.90, users get access to all essential functions and services, as well as the versatile insurance package from N26.

Payment options and money management

The N26 corporate credit card offers several practical features to simplify managing and handling your money. Below, we summarize the key features, from accounting tools to mobile payment options.

Real-Time transfers with MoneyBeam

Managing business expenses can be particularly important for quick, clear, and easy money transfers. With the MoneyBeam feature, you can send money to other N26 users within seconds. Unlike “regular” real-time transfers, you don’t need to enter the bank details and BIC for each transfer; you only need to save your contacts’ details once. This allows you to send money with just a few clicks and request MoneyBeams from other N26 users. MoneyBeams have a daily limit of €5,000.

If you urgently need to pay invoices that are not to another N26 customer, N26 Business You also offers free “regular” SEPA real-time transfers.

Mobile banking and free transactions

Another advantage of the N26 You business account is that you can make unlimited transactions for your business without additional costs. Moreover, N26 allows you to manage your account via your computer or mobile app. You can easily download account statements and use many other functions through the user-friendly web app.

Save time with sub-accounts “spaces”

N26’s Spaces are sub-accounts designed to help you manage and save your money. You can create up to 10 Spaces and assign each one an individual IBAN. This allows you to categorize sub-accounts and assign different functions to them. For example, create a Space titled “Travel Expenses” and allocate all your costs for future business trips there. You can also set up standing orders for monthly payments and make SEPA transfers directly from any of your chosen Spaces. Linking your N26 Business You card to a Space of your choice is simple, ensuring that funds are deducted directly from the chosen Space with each payment.

If you work in a team, you can create a Shared Space to manage savings goals, budgets, and expenses with up to 10 other N26 users.

Saving made easy

With the practical income splitter, N26 offers another feature to facilitate saving money. Users can automatically allocate a portion of their incoming funds to their Spaces. This is particularly useful for setting aside money for future payments. You can flexibly determine when and how much money should be set aside.

For example, if you want to save for a new PC, you can set the app to allocate 10% of any incoming amount of at least €300 to the “PC” Space.

There is no fixed minimum amount. You can decide whether to set aside a percentage from as little as €20 or only from high sums like €2,000.

Payments and withdrawals abroad

The N26 You account is also suitable for self-employed individuals who travel frequently abroad. Entrepreneurs can withdraw cash worldwide for free with their N26 Business Mastercard. There are no additional costs for local or online purchases, regardless of the currency used.

Cashback

With an N26 business account, entrepreneurs and freelancers also benefit from the cashback feature. When you open a Standard or You subscription, you receive 0.1% cashback on all business purchases made with the Mastercard. With N26 Metal, it’s even 0.5%.

Versatile insurance package

With N26 You, customers benefit from a versatile insurance package that provides excellent coverage on business trips. The insurance package includes travel delay, trip interruption, trip cancellation, and luggage loss insurance.

The travel delay insurance applies if your trip is delayed by more than 2 hours. The trip interruption insurance compensates you with amounts up to €10,000 for accommodation or transportation costs. The luggage loss insurance provides compensation up to €2,000.

Medical emergencies are also covered: travel health insurance covers emergency medical interventions (including dental) up to €1,000,000.

Earn interest

With an N26 You account, you get free access to a free savings account. This account earns 2.26% interest per year on amounts you save. The interest rates are always calculated daily and accurately, with your savings value automatically adjusted.

To use the savings account, you need to submit an application through the N26 website, confirming your identity. The savings account is usually activated within approximately 24 hours after successful verification.

Your savings are protected up to €100,000 by the German deposit insurance system, so you don’t have to worry about the security of your money.

Attractive partner offers

With N26 Business You, you have access to exclusive discounts. Users can enjoy top-notch offers and discounts from renowned brands. Partnerships include companies like Bolt, Rentalcars.com, Booking.com, and Grover. The current partner offers can be conveniently found in your N26 app.

Other Cards from N26

If you are looking for a card with different conditions from this provider, you might also be interested in the N26 Business Smart and N26 Business Standard corporate credit cards!